Tax Incidence Perfectly Inelastic Supply

It is the responsiveness of on.

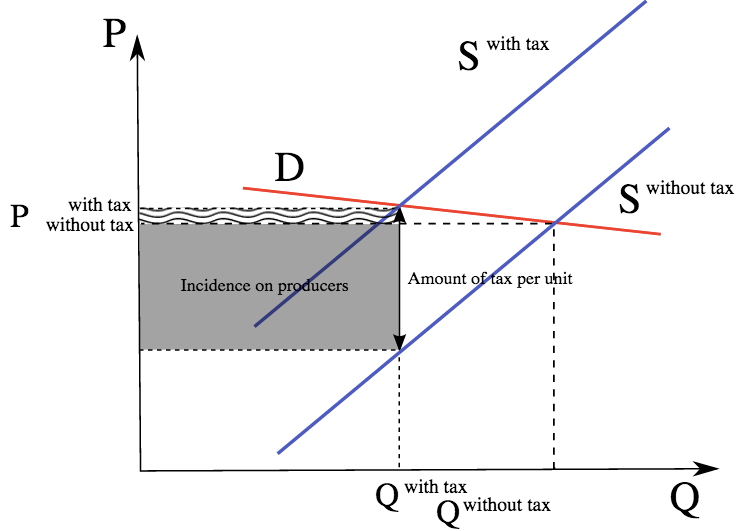

Tax incidence perfectly inelastic supply. But there are some products that come close to being perfectly inelastic. Take gasoline for instance. These prices change frequently and if the supply drops prices. Lecture on the effects of a per unit tax.

The lecture material is developed on the assumption that students have previously been introduced to step function market. The price elasticity of supply measures how the amount of a good that a supplier wishes to supply changes in response to a change in price. In a manner analogous to. Learning objective the purpose of studying elasticity is to determine how a small change in price may result in either a large or small change in.

A landlocation value tax lvt also called a site valuation tax split rate tax or site value rating is an ad valorem levy on the unimproved value of land. Importance of the concept of elasticity of demand. The concept of elasticity of demand plays a crucial role in the pricing decisions of the business. C jason welker 2009 1 zurich international school ap microeconomics.

Exam study guide format. 60 mc questions worth 6667 of total. 70 minutes to answer. This assignment will examine one of the most important concepts in the whole of economics elasticity.