Collar Option Strategy

1 strike price also called the exercise price.

Collar option strategy. What is collar strategy. See detailed explanations and examples on how and when to use the collar options trading strategy. Collar option strategies are a protective strategy that is implemented on a long stock position. An investor can create a collar position by purchasing an out of the.

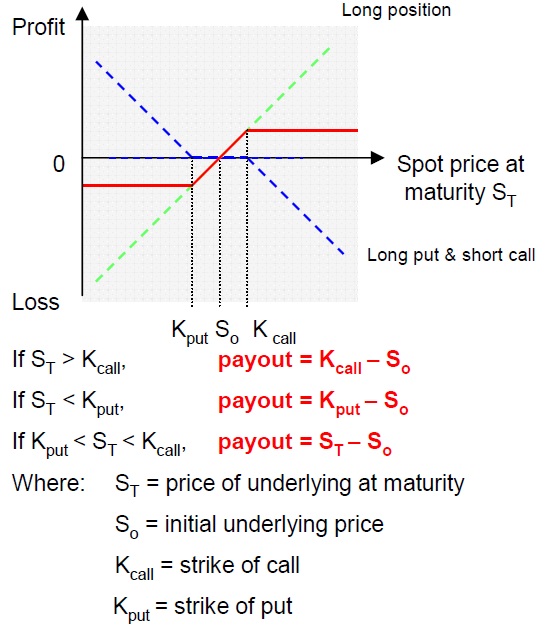

What is costless or zero cost collar. See detailed explanations and examples on how and when to use the costless or zero cost collar options strategy. A zero cost collar is an options strategy used to lock in a gain by buying an out of the money otm put and selling a same priced otm call. In finance a collar is an option strategy that limits the range of possible positive or negative returns on an underlying to a specific range.

A collar strategy is. The major concern for covered call writers is the stock price dropping in value. The option premium collected is money in the bank. The components of the option chain columns from left to right.