Short Collar Option Strategy

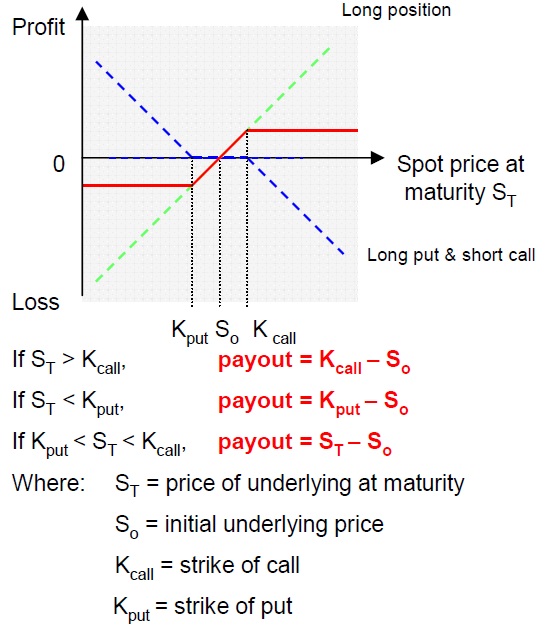

A zero cost collar is an options strategy used to lock in a gain by buying an out of the money otm put and selling a same priced otm call.

Short collar option strategy. What is collar strategy. See detailed explanations and examples on how and when to use the collar options trading strategy. Collar option strategies are a protective strategy that is implemented on a long stock position. An investor can create a collar position by purchasing an out of the.

What is costless or zero cost collar. See detailed explanations and examples on how and when to use the costless or zero cost collar options strategy. 40 detailed options trading strategies including single leg option calls and puts and advanced multi leg option strategies like butterflies and strangles. Online option strategy analyzerstrategy screenerscreen for covered call covered put screeneroption priceroption calculator.

The drastic increase in prgo share price and its corresponding option premium in such a short period of time prompts us to explore the potential to generate more. A short straddle is a non directional options trading strategy that involves simultaneously selling a put and a call of the same underlying security strike price and.